2022: A Turning Point for Public Chains

From the fall of Luna in the first half of 2022 to the collapse of FTX at the end of the year, 2022 has been the year of the “black swan” for the crypto world. Despite the dark clouds over the crypto market, numerous developers and long-term believers remain convinced that the bear market is not far from over. As the booming development of public chains boosts confidence among users, 2022 has also marked a turning point for those who participate in public chains.

Terra: $20 billion TVL crumbled into dust overnight

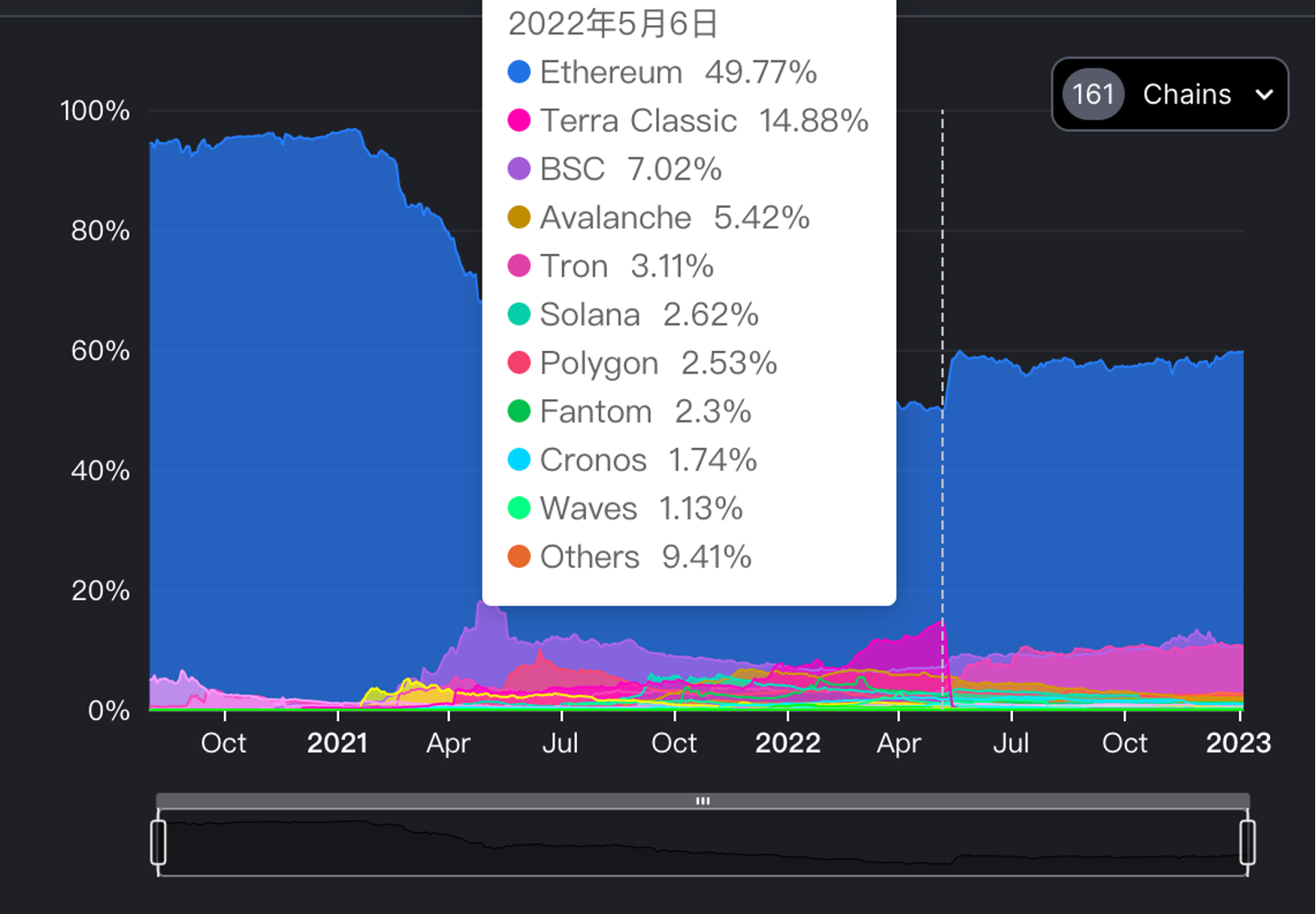

In 2021, Terra built a complete decentralized finance (DeFi) ecosystem focusing on UST, an algorithmic stablecoin. Thanks to the fixed-rate protocol Anchor with an annual percentage yield (APY) of 20%, Terra has emerged as one of the public chain ecosystems attracting the most discussion and usage. Its share of total value locked (TVL) rose to 14.88%, second only to Ethereum.

Data source:DefiLlama

Well known for its high deposit yields, the controversial Anchor protocol has been labeled as a Ponzi scheme. However, the APY of 20% is still a lure to many users who choose to deposit UST in Anchor, which sends Terra’s TVL to an all-time high of over $20 billion.

Data source:DefiLlama

In May 2022, UST on the Curve was sold massively, and the liquidity pool became imbalanced. As a result, UST decoupled from USD and could not be anchored in the long term. Due to the market panic, a massive amount of UST was removed from the Anchor protocol and then was quickly sold. This selling pressure on UST led to a reflexive downward spiral, known as a “death spiral”. The plummet of UST became the most sensational black swan event in 2022. After UST lost its stability, Terra, a public chain that was once given high hopes, had collapsed with its TVL of $20 billion crumbling into dust overnight.

Ethereum: Post-merge deflation

After countless delays, the Merge of Ethereum, the largest public chain ecosystem with 8 years of existence, finally took place, switching the blockchain protocol from the proof of work (PoW) to the proof of stake (PoS). Although the Merge did not substantially boost the TPS of Ethereum, the subsequent sharding will bring improved performance.

Vitalik, founder of Ethereum, once talked about Danksharding, a new sharding design proposed for Ethereum. The combination of sharding and Rollup can improve the performance of Ethereum to 80,000 TPS, which is equivalent to that of background systems commonly used by banks. In other words, the performance of Ethereum will meet the daily needs of numerous users at that time.

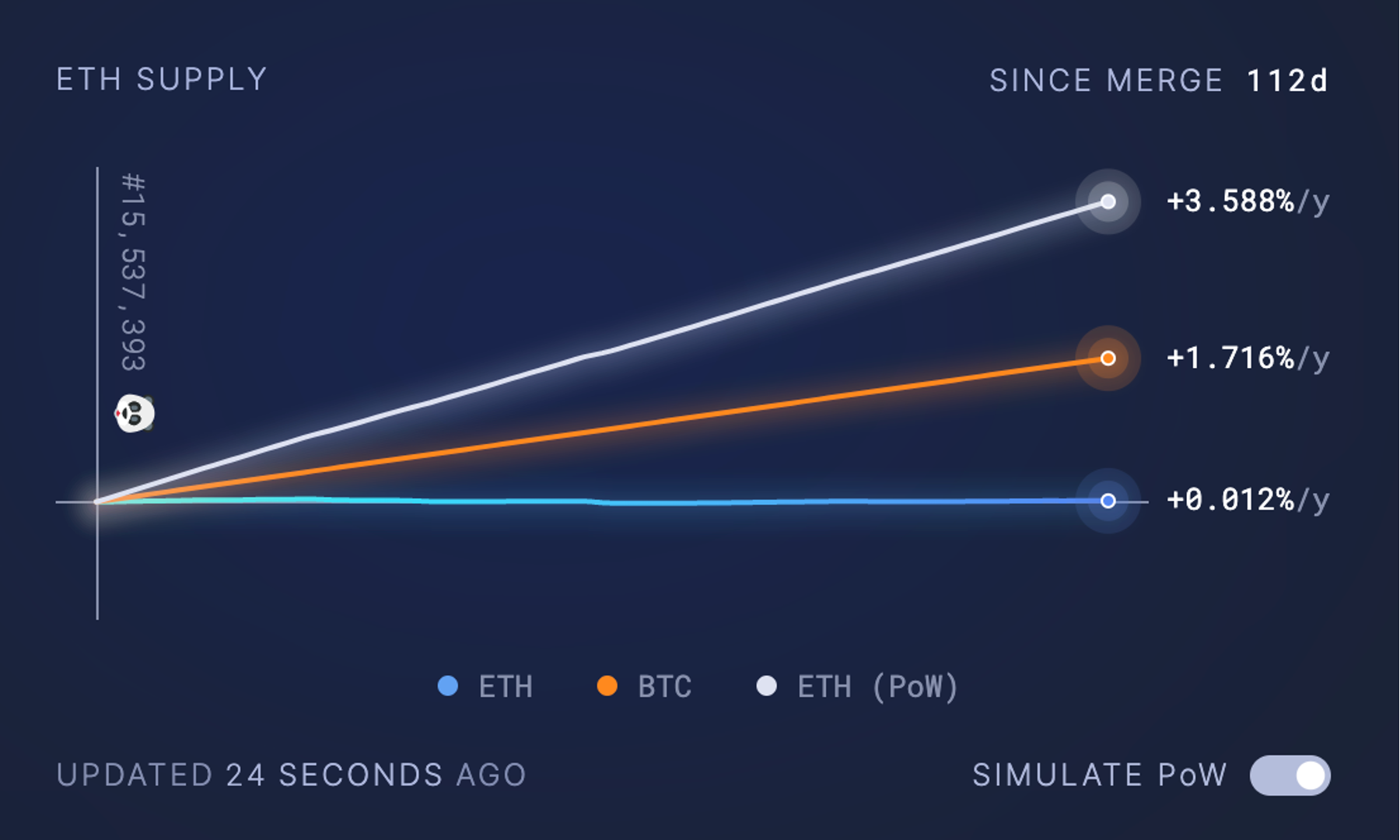

After the Merge, the ETH issuance declined significantly. ETH had even remained deflationary for some time. If the PoW mechanism remained at work, over 1.3 million ETH would have been issued from September 15 (the date of merge) to January 5, 2023. But it turns out that merely 4,500 ETH have been issued ever since, with the annual issuance rate dropping from 3.588% to 0.012%, thus forming a healthier economic model.

Data source: ultrasound.money

Layer 2: A challenge to Layer 1

It is widely believed that 2021 is the year of new Layer 1 public chains and 2022 sees the rise of Layer 2 public chains. Over the past year, Rollup solutions such as Optimism, Arbitrum, StarkNet and zkSync have been updated over again. Optimism’s Bedrock has been upgraded smoothly and is expected to be launched in 2023, which will reduce its transaction fees and increase the TPS. Arbitrum introduced Nitro with better compatibility. The StarkNet mainnet has been upgraded several times to improve the transaction processing speed. The zkSync2.0 mainnet has been basically completed and is expected to be gradually open to ecosystem partners and users in 2023.

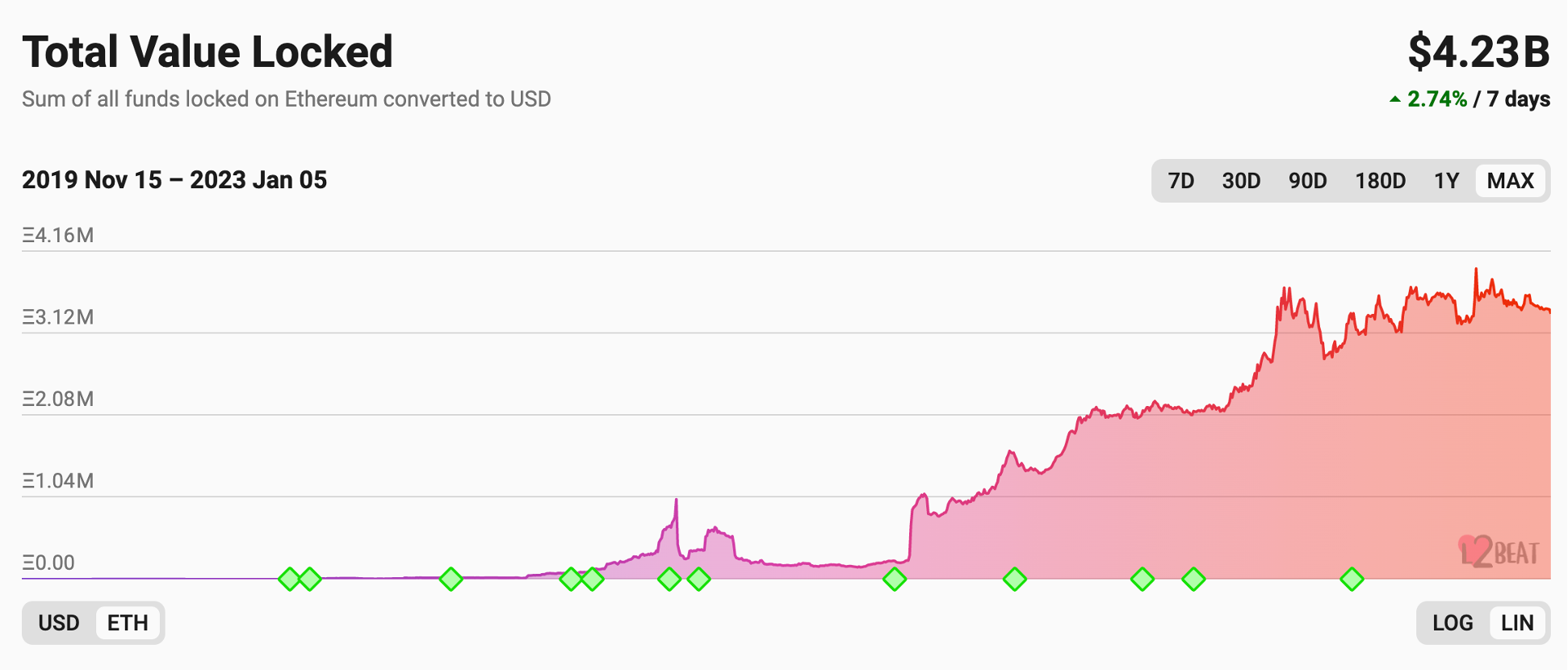

Thanks to the updates of the Layer 2 technology, its TVL peaked at nearly 4 million ETH in November 2022, up from 1.5 million ETH in early 2022. The availability of Layer 2 has been more widely verified and recognized.

Data source: L2BEAT

Newcomer: Public chains with the Move programming language

Layer 1 public chains with the Move programming language undoubtedly came as the greatest surprise in 2022. As a legacy of the abortive Diem project, the Move language is safer and more flexible than the Solidity language used in Ethereum. In addition, Aptos and Sui, two typical public chains that adopt the Move language, were developed by the teams from Diem and Novi projects of Meta, and thus have been favored by many top investors.

Aptos received $350 million in investment, and launched its mainnet in October 2022. It has airdropped tokens worth more than $1,200 to its early testnet users. Driven by its popularity, many Solona projects have turned to Aptos. Currently, Aptos has nearly 100 projects, which cover such areas as infrastructure, games, NFT and DeFi and bring along a booming ecosystem. In 2022, Mysten Labs, developer of Sui, raised $300 million and was expected to officially launch its project in 2023.

2022 has been a bumpy year for the crypto market plagued by black swan events including the collapse of the Terra ecosystem. Fortunately, Ethereum, Layer 2 and new Layer 1 public chains have made some breakthroughs, and have never ceased to explore and develop new programming languages, modular public chains, sharding technology and scaling solutions such as Rollup, making 2022 a turning point in the history of public chains.

At present, CoinEx Wallet has supported 48 mainnet assets and over 1 million tokens. In the future, CoinEx Wallet will continue to follow the development of public chain ecosystem, list new assets, and provide users with more asset management services and access to decentralized applications.