Be Careful with Fake Cryptos

When using crypto products such as wallets and exchanges, protecting the security of your assets is the No.1 priority. In “CoinEx Wallet Security Tips”, we will share some basic crypto know-how such as common scams, how to use crypto products safely, and blockchain security mechanisms from multiple perspectives to help you fully understand asset security and adopt enhanced protection measures.

In real life, we sometimes receive counterfeit money, and scammers rely on different techniques to print out fake money for illegal gains. However, as online payment becomes more prevalent, fake money has become less common.

Cryptocurrencies, which are based on blockchain technology, record everything onto the chain, and all statistics are immutable. So, there couldn’t be fake cryptos, right? Yet, the fact is that the crypto market always abounds with plenty of fake coins, and users could become victims if they are not careful.

Although the DeFi boom has created more investment opportunities, it has also brought various fake crypto scams that are more difficult to spot. For instance, there are projects where developers suddenly withdrew all the funds from the DEX liquidity pool and ran away with investors’ assets, resulting in huge losses. To keep our assets secure, we must be careful and stay on guard.

I. Types of fake cryptos and cases

Over the recent years, as the crypto market keeps expanding, the huge returns of cryptocurrencies have attracted droves of new investors to the market, and they are also targeted by more and more scammers. Meanwhile, public chains have progressed, and the bar for issuing cryptos has been significantly lowered in terms of technology and funding. There are even tools that teach people how to issue cryptos with simple operations within a few minutes. In today’s crypto space, anyone could issue any amount of crypto on Ethereum or other public chains at low costs.

There are fake cryptos on almost any public chain, and Ethereum has the largest number of fake cryptos because it is the most successful public chain in terms of the user base and trading volume. In the Ethereum network, countless shitcoin projects are launched almost every single day, and some of them are “modified” ERC-20 tokens. Common fake cryptos include:

1) Tokens with the same name as a famous project

On Ethereum, there are fake cryptos that copy big-name projects, such as UNI, AAVE, and LINK, and all of them are scams that sell fake cryptos. For instance, if you search USDT on Ethereum, you’ll see hundreds of tokens, all of which are fake cryptos except the real USDT.

2) Cryptos that can be bought but not sold

Some fake cryptos have built contracts with a “back door”, and users can only buy such cryptos but not sell them. When browsing cryptos on a DEX, users might be attracted by the appealing price of such cryptos. However, they are run by scammers, and an “error” will be reported when users try to sell these cryptos because the “buy-only” restriction has been added to their smart contract, which makes them another fake cryptocurrency.

3) Administrators can issue cryptos or freeze addresses without any limit

Some scammers would grant themselves extraordinary power when issuing tokens, allowing them to, for instance, issue cryptos or freeze a certain address without any limit. To put it more bluntly, if you hold a token without any cap on the supply, it has little value, which constitutes another type of fake crypto scams.

4) Rug Pull scams

Along with the DeFi boom, Rug Pull scams have become more prevalent, resulting in growing losses. Rug Pull has become the most common fake crypto scam.

What is a Rug Pull? This type of crypto scam is easy to understand. Firstly, the scammers would issue a token and promote their project in different crypto communities to convince more users of its prospects. They would then build a liquidity pool at a DEX, such as XXX/USDT pool, to encourage stake mining or trading. When the pool reaches a certain scale, the project team (scammers) would pull away all the funds.

Rug Pull is now the most prevalent DeFi scam. The reason why scammers easily get their way is that they can create liquidity pools and list any token on a DEX. After all, token listing and trading are decentralized on DEXes. Unlike on centralized exchanges, there are no strict token-listing criteria on DEXes. While providing us with more conveniences, decentralized exchanges have also allowed scammers to run their tricks.

For example, AnubisDAO was launched in October 2021. Without any website or whitepaper, the project only has a logo that’s similar to Dogecoin (DOGE). Moreover, the developers in its project profile are also faked. Despite that, investors pumped nearly $60 million into the project’s liquidity pool overnight. Twenty hours later, all the funds (mainly wETH) disappeared from AnubisDAO’s liquidity pool and were transferred to a series of new addresses, incurring huge losses to users.

II. How to identify fake cryptos

How should we avoid the above scams in the market that abounds with fake cryptos?

1)Check the contract address of real cryptos

It is well-known that each token issued on a public chain features a unique contract address. Even if two tokens share the same name, their contract addresses must differ. As such, we could avoid fake cryptos by checking the contract address of the real ones. Moreover, we can also find the real cryptos by searching their contract addresses on a DEX.

Therefore, we need to check the official website of the real project to find the contract address of the token. Then, we should search for the token through the contract address for DeFi operations like transactions and financial services.

2) Spot fake cryptos via tools

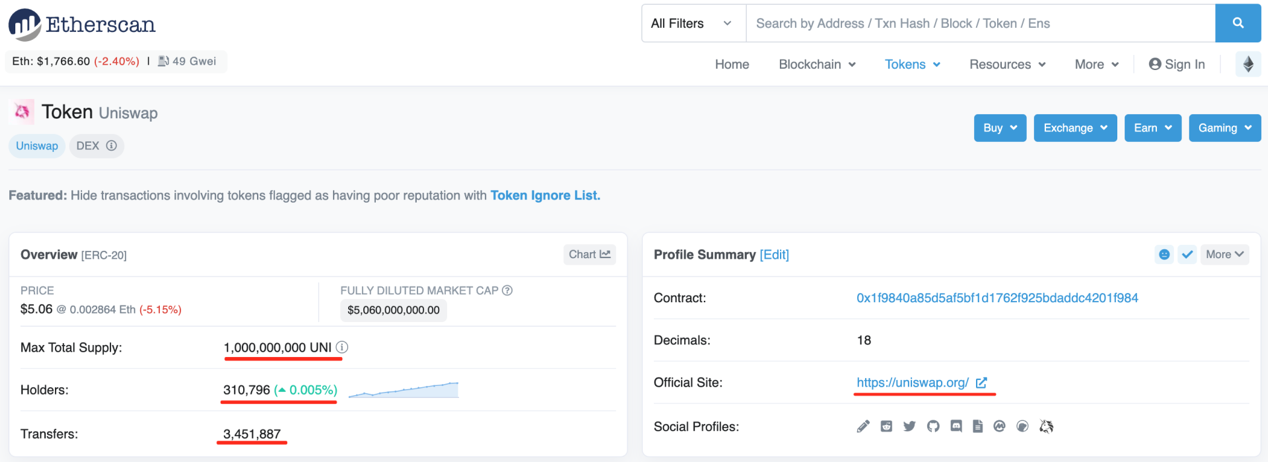

Many public chain ecosystems provide a full range of tools. For instance, in the Ethereum ecosystem, we can spot fake cryptos with etherscan.

First of all, we should go to https://etherscan.io/ and then enter the token name in the search box. After finding the token, we can check whether it is a real project through its total supply, the number of holders (non-zero addresses) and transfers, and the official website address.

For instance, in the above example, the total supply as well as the number of holders and transfers of UNI are large. Plus, the link to the official website also matches the token description on the page. However, fake cryptos often come with a small number of holders and transfers. After all, most fake cryptos are held and traded by scammers themselves.

3)Adopt a decent crypto wallet

When trading tokens or using DeFi services, we should use a decent and secure crypto wallet like CoinEx Wallet.

When users are carrying out DeFi operations in CoinEx Wallet, the wallet acts as the first security barrier.

4. Do not get greedy

Greed usually leaves you vulnerable to scams. If you could stay rational, then you would be able to avoid most crypto scams.

To sum up, there are plenty of fake crypto scams in the market. When trading cryptos, we should first check the only contract address corresponding to the project token and adopt a decent crypto wallet and a sound DEX. In addition, we can also tap into tools like blockchain explorer to identify fake cryptos. Last but not least, we should also refrain from getting greedy.