Liquidity Staking Explained

Web3 is often referred to as the next generation of the Internet, and crypto wallets are considered the gateway to the world of Web3. To fully prepare you for a Web3 adventure, CoinEx Wallet has introduced a series of Web3 know-how articles, illustrating the current status and future development of the Web3 industry.

On April 12 (UTC), Ethereum successfully completed the Shapella upgrade at epoch 194,048, and the staking function of the Beacon Chain, which was launched more than two years ago, has finally allowed withdrawals. Now stakers can withdraw their locked ETH and earnings, which marks the completion of the final step of Ethereum's transition to PoS. This transition has also led to the rise of a new track—liquidity staking.

The necessity of liquidity staking

In the article Consensus - The Law of the Blockchain World, we detailed the consensus mechanisms of public chains. Currently, the industry’s consensus mechanisms are still mainly based on PoW and PoS as well as their variants.

The PoW mechanism requires a large number of miners to package data and collectively maintain the network. To improve efficiency and allow miners with small computing power to earn stable income, mining pools like ViaBTC have emerged. They combine the computing power of miners and mining farms scattered around the world to ensure stable income for each contributing miner.

Similar to miners, the PoS mechanism also functions as validators. Validators need to lock up their tokens to maintain network nodes. The tokens locked, though beneficial to network security, cannot be circulated. If the DeFi yield earned by liquidity providers (LP) is higher than the staking yield on the Beacon Chain, some users, driven by profits, may abandon staking for liquidity mining.

To improve the capital utilization efficiency of validators, the industry has proposed a solution called liquidity staking, which allows users to unlock the liquidity of the staked tokens and invest the tokens in collateral lending, trading, or other derivative services.

The liquidity staking mechanism

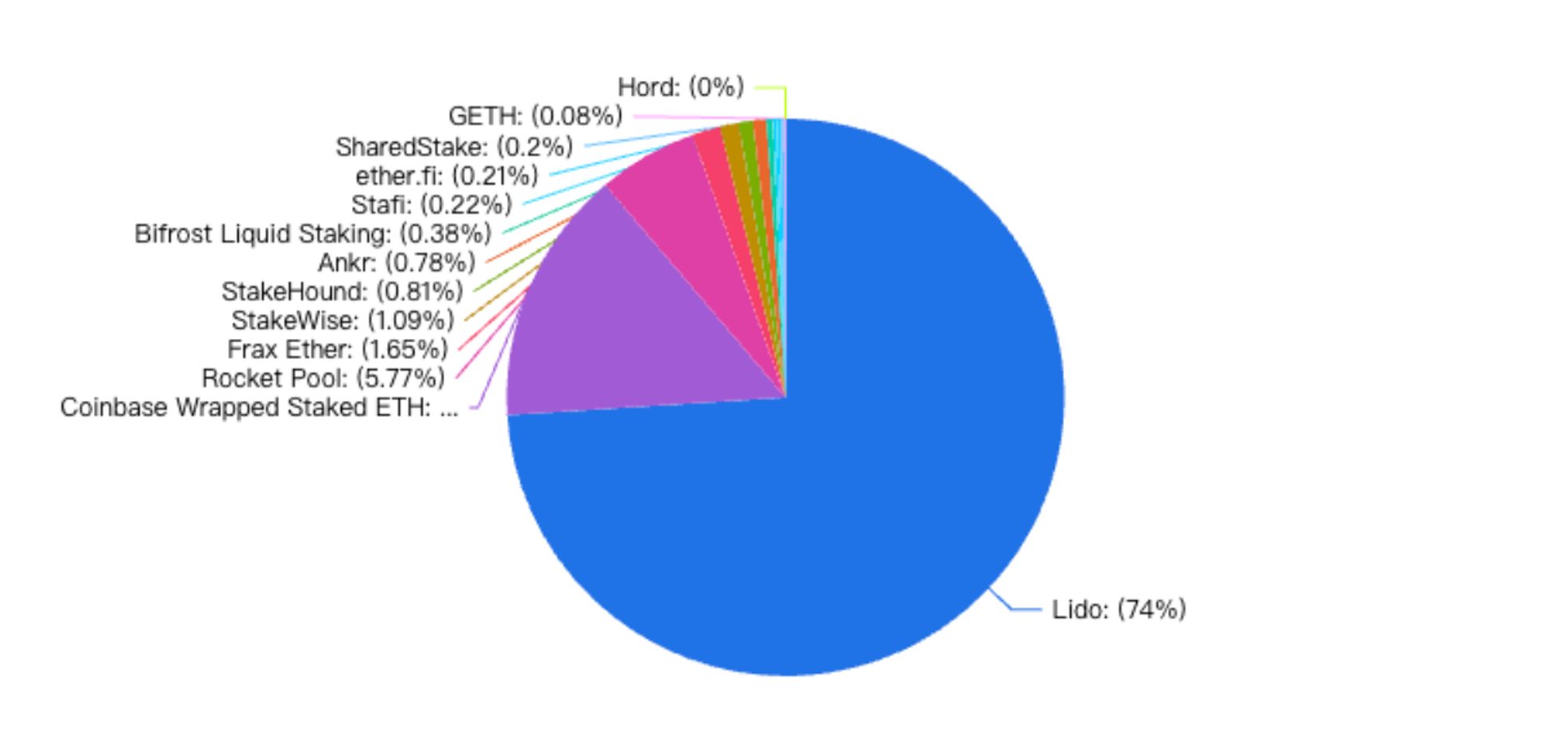

There are many liquidity staking protocols on the market, the best-known of which is Lido. Lido is currently the largest Ethereum liquidity staking protocol, with a market share of 74%. Here, we will use Lido as a typical example to explain what liquidity staking is.

Source:DeFiLlama

Users can use Lido to stake ETH on the Beacon Chain. After staking, Lido will mint stETH tokens as the staking certificate for the staker in a 1:1 ratio. The stETH balance will also reflect the staking rewards that users have earned. As staking ETH generates rewards, the balance of ETH held by the staker on the Beacon Chain will also increase. Lido updates the stETH balance for users every day based on the staking rewards. The staker's stETH balance equals the initial staking amount plus staking rewards minus penalty fees.

stETH can be used and traded like ETH, including trading on DEXs such as Curve and Balancer, or being used as collateral for borrowing and lending on protocols such as AAVE and MakerDAO. This allows stakers to unlock the liquidity of the tokens they staked and obtain revenue beyond staking rewards from other protocols.

In addition to Lido's stETH, there are other Ethereum liquidity staking tokens (LSTs) on the market, such as Coinbase's cbETH, Rocket Pool's rETH, Frax Finance's frxETH, and Ankr's aETH. Furthermore, many liquidity staking protocols also support other PoS public chains. For example, Lido provides stMATIC and stKSM, while StaFi provides rATOM, rBNB, rDOT, and rSOL. With the completion of the Shapella upgrade, the Beacon Chain has allowed ETH withdrawals, which means that LSTs such as stETH can be withdrawn and exchanged for ETH.

How to engage in liquidity staking?

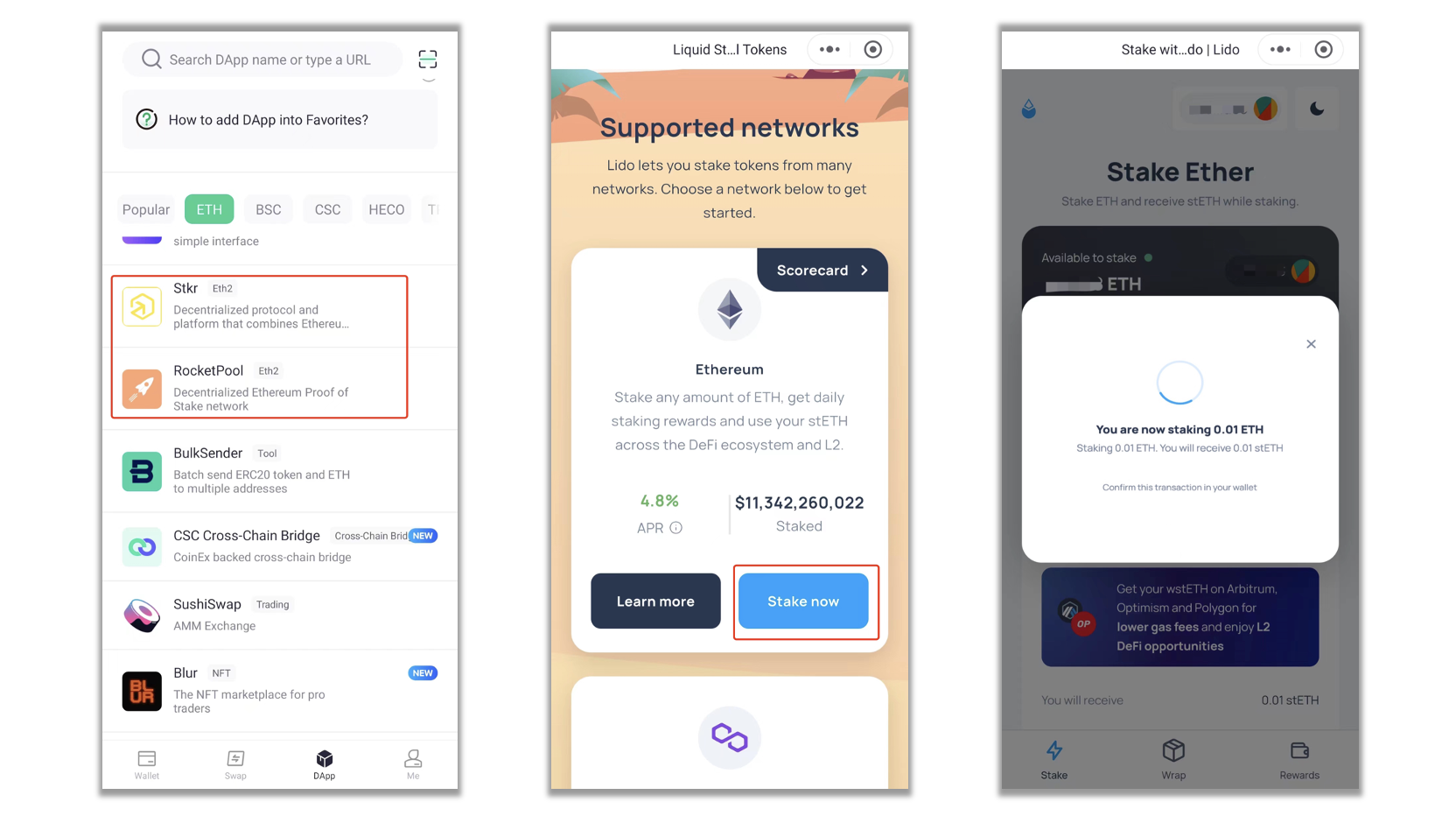

At present, CoinEx Wallet supports many liquidity staking protocols, including Rocket Pool and Stkr. Users can also enter the website of different liquidity staking protocols on CoinEx Wallet for staking.

Here is an example:

1. In the DApp section of CoinEx Wallet, find the protocol labeled Eth2, which represents liquidity staking protocols. Alternatively, you may enter the website of the liquidity staking protocol you want to use and access the website.

2. After entering the protocol, select the asset you want to stake, such as ETH, MATIC, etc., and tap "Stake now."

3. In the staking page, enter the amount of ETH or other tokens you want to stake, tap "Submit", and confirm the transaction in your wallet.

After the above steps, you’ve successfully completed a liquidity staking transaction and will receive the corresponding amount of stETH or other LSTs. You can now enjoy the benefits of staking ETH while using the LSTs for other purposes on different protocols.

Procedures of Liquidity Staking on CoinEx Wallet

CoinEx Wallet now supports multiple public chains' liquidity staking protocols and applications, providing limitless access to the Web3 world for all users. If you are interested, please join us at: https://wallet.coinex.com/.