NFTs: More than Collectibles

Even if you are not familiar with NFT, you would always associate the term with “getting rich quick”, “collectibles”, “speculation”, etc.

The concept of NFT was first proposed by Dieter Shirley, the founder of CryptoKitties, in 2017. As the first widely recognized blockchain game, CryptoKitties allowed most users to try out ERC721 tokens for the first time. To better distinguish these tokens from common ERC20 tokens, Dieter Shirley proposed the concept of NFTs (non-fungible tokens).

From a technical perspective, an NFT is an encrypted digital proof of rights and interests based on blockchain technology that cannot be copied, tampered with, or divided. For example, when buying an NFT avatar, the “goods” we receive is an address consisting of a string of characters that serve as the digital copyright certificate of the NFT. The address runs on the blockchain, and the transaction records are transparent and immutable. What this means is that even if someone were to copy the image of the “avatar”, it would not be “authentic”, and the only “authentic” version cannot be copied or divided (an NFT cannot be divided into smaller units). Therefore, owners of an NFT address also own its copyright.

Since NFTs are tokens, they can be understood as decentralized “virtual assets”. Meanwhile, as NFTs are also proofs that cannot be copied or tampered with, they can be regarded as “digital ownership certificates of physical assets”. Right now, the primary application scenarios of NFTs include digital collectibles, crypto in-game assets, equity, and certificates. In the future, NFTs will gradually be applied to more financial derivatives.

NFTs are issued in the form of smart contracts (computer protocols designed to transmit, verify, or enforce contracts through information). A smart contract can issue one or more NFT assets. For example, among the mainstream protocols, an ERC721 smart contract can only issue one type of NFT asset (CryptoKitties, Decentraland, or other applications), while ERC1155 allows a contract to issue any type of NFT assets (e.g. the trading platform OpenSea’s native token OpenStore). NFT smart contracts record the information about each NFT asset, covering their token ID, storage address, etc.

As the copyright of various digital products capture the spotlight, the scope of art collections has been expanded. At the same time, driven by market hypes in the crypto investment community, more types of NFTs have emerged, including pictures, audios and videos, digital copyright proofs, games, social metaverse, and more.

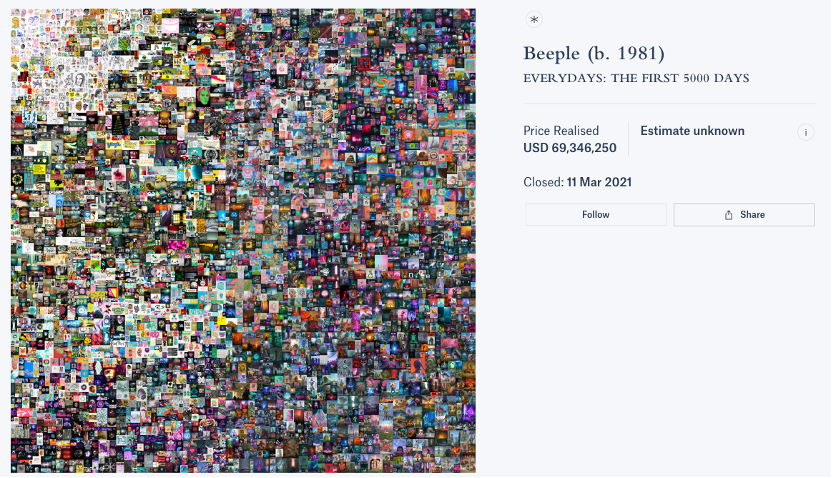

In March 2021, Beeple’s NFT art “Everydays: The First 5000 Days” fetched about $69.3 million at Christie’s auction house. In September of the same year, NBA player Stephen Curry bought the digital ownership of a BAYC NFT for 55 ETH. The auction of Beeple’s work created instant recognition of NFT among investors, while Stephen Curry’s NFT purchase introduced the general public to the concept of NFTs.

Figure 1: Auction record of Beeple’s work at Christie’s

(Source: Christie’s)

The NFT market continues to expand. Apart from digital artists, physical businesses are also turning their focus to the NFT segment. In February 2022, Puma, a company listed in Germany that owns the world’s third-largest sports brand, changed its account name “PUMA” to “PUMA.eth” on Twitter. This “new name” is an ENS domain name, which is also a type of NFT. Industry insiders believe that the upgrade means that Puma is not only becoming more professional in the field of NFT but is also ready to venture into the broader Web3 world.

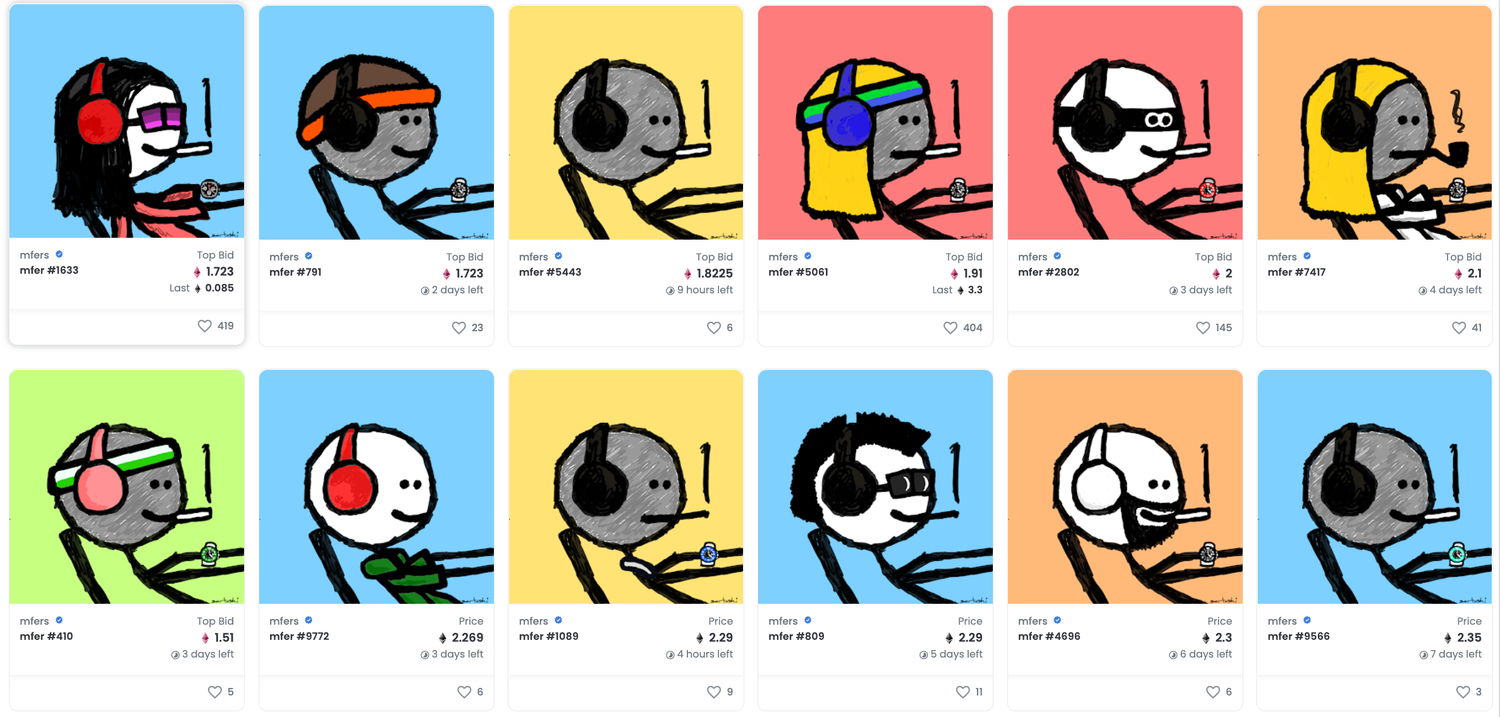

As a crypto user, if you wish to participate in the NFT sector, the easiest method is to buy NFT collectibles in a marketplace, as Stephen Curry did. For example, you could get mfer NFTs, which are trendy these days.

Figure 2: mfer NFTs

(Source: OpenSea)

Or you could also engage in social interactions and trade virtual assets in a metaverse game:

Figure 3: The Gaming Metaverse of Decentraland

(Source: twitter@decentraland)

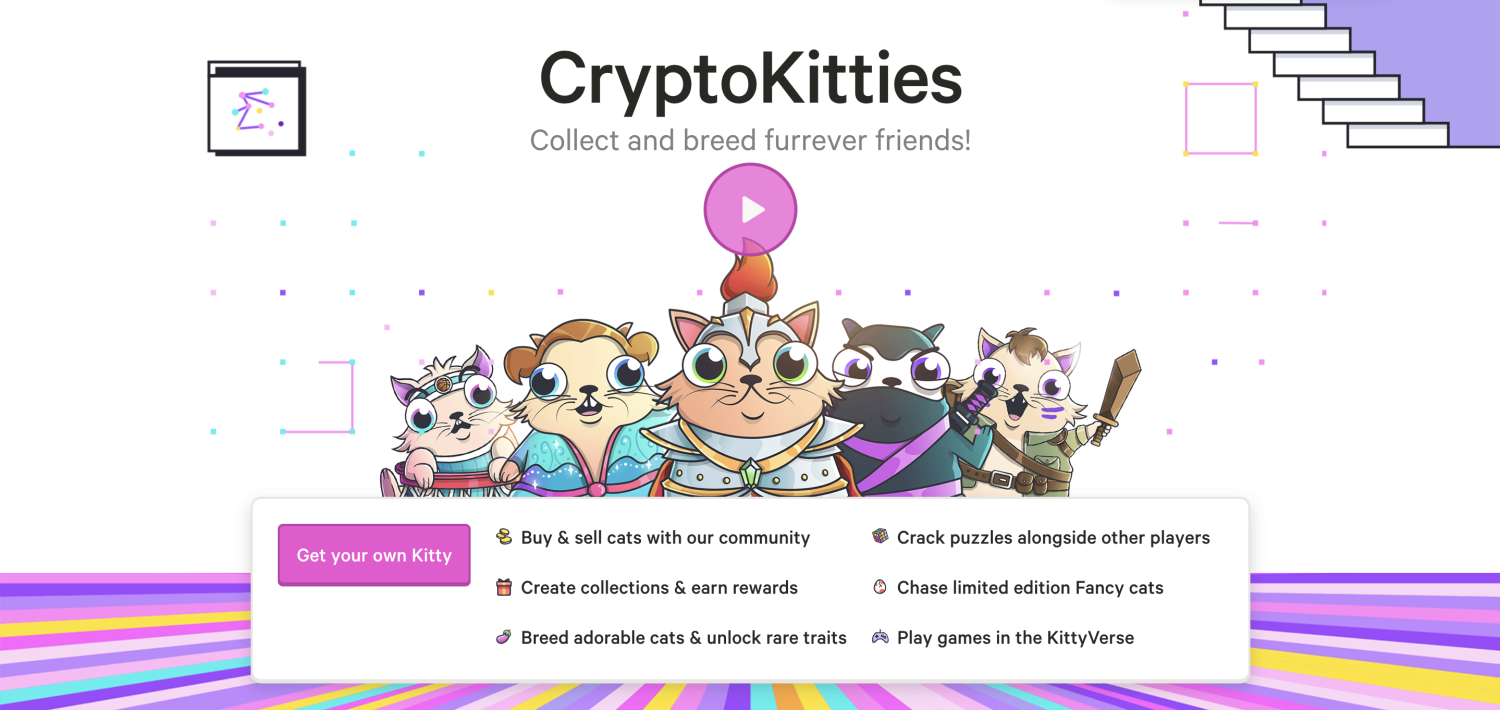

Or you could get a lovely pet in a blockchain game:

Figure 4: Raise Pet NFTs in Cryptokitties

(Source: CryptoKitties)

Or you could also apply for a cool, unique decentralized domain name on platforms like ENS and DAS:

Figure 5: VitalikButerin

(图片来源:twitter@VitalikButerin)

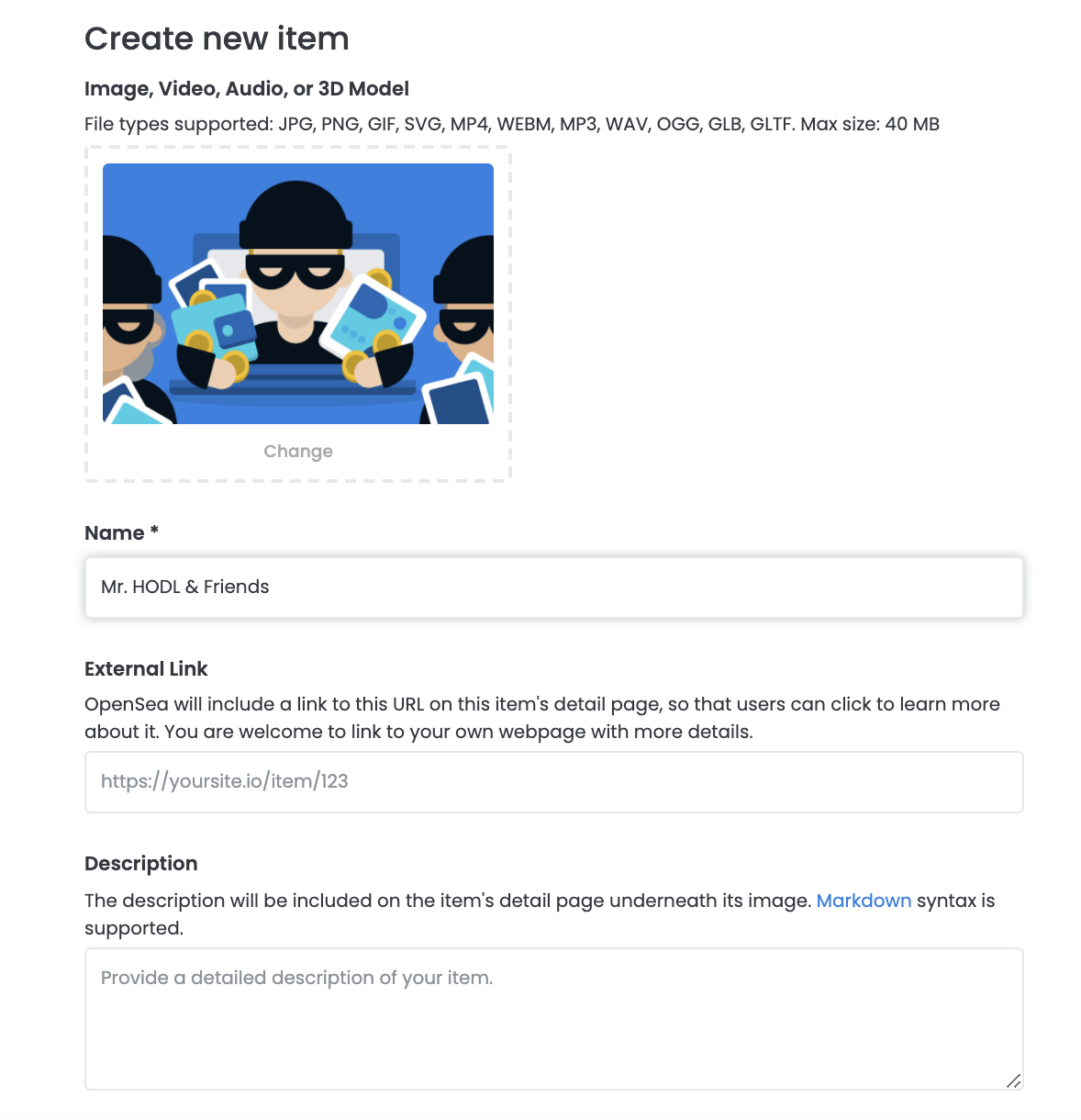

Of course, you could also choose to build your own NFT artworks as an NFT artist:

Figure 6: Become an NFT Creator on OpenSea

(Source: OpenSea)

There are a lot more scenarios where NFTs can be used. At the moment, the most popular use cases of NFTs include artworks, games, and the confirmation of digital rights. In the future, NFTs will be applied to more practical projects. NFT players should be clear that essentially, NFTs are assets for investment. As such, they come with certain risks. In addition, as most NFTs are sold via auctions, their value is largely dependent on the subjective judgments of buyers and sellers, and investors should make prudent decisions before investing in NFTs.

Do you want to find out more about the NFT market? Would you like to experience NFT management functions like storage, transfer/receipt, and transaction? Download CoinEx Wallet (https://wallet.coinex.com/download) to try out smooth NFT management experiences and explore more interesting NFT DApps!