What Are Synthetic Assets?

Amid the DeFi projects, a unique program called synthetic assets (synths) has long set the pace, whose design is more complicated. In simple terms, it simulates the price of other assets and converts them into digital assets, allowing users to trade directly on the blockchain.

In the DeFi world, people can often buy and sell assets such as Bitcoin and Ethereum. However, assets such as stocks, precious metals, and commodities in the traditional financial market cannot be traded on the blockchain. At this time, a project team proposed the concept of synthetic assets, which is analogous to derivatives in the traditional financial market. For example, just like AVR helps investors buy Hong Kong stocks in the U.S. stock market, synthetic assets are similar digital assets pegged to the corresponding trading object.

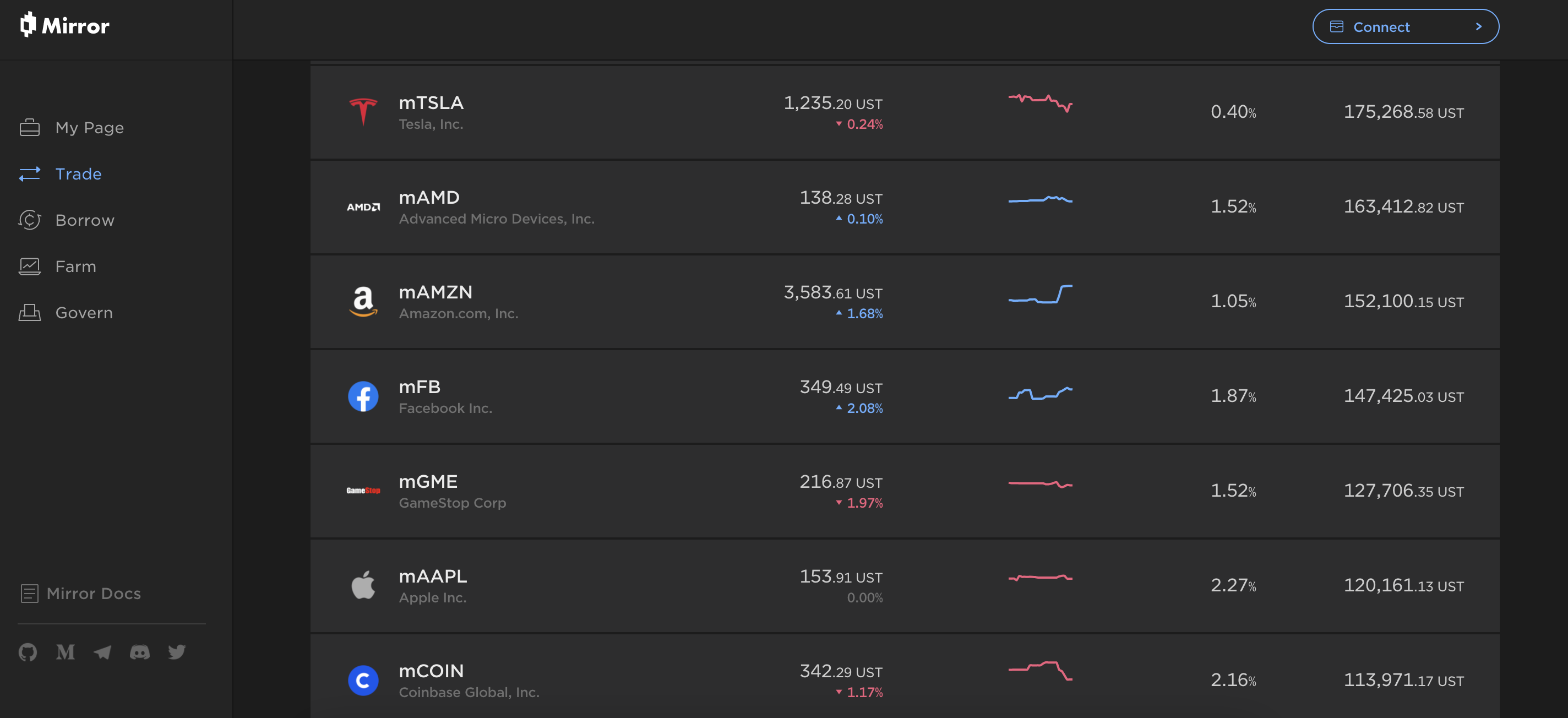

Synthetic assets directly copy the price of an object traded in a traditional exchange market, enabling its on-chain trading. For example, users can create a synthetic asset based on Tesla's stock module, such as mTSLA on Mirror Protocol, a decentralized blockchain-based protocol for synthetic assets. Of course, in addition to stock prices, synthetic assets can also be pegged to other assets such as legal tender, gold, and BTC.

The emergence of synthetic assets provides convenience for global cryptocurrency users. For example, when a user wants to buy Apple stock in a particular country/region but is banned by the local authority, if he happens to be a crypto enthusiast, he can buy in Apple’s synthetic assets as an alternative option.

In particular, CoinEx Wallet has provided its users with possibilities to trade synthetic assets on Synthetix. The users over-collateralize the native currency of Synthetix, SNX, on Mintr as collateral, thereby minting the stablecoin sUSD, which is pegged to the U.S. dollar at a 1:1 ratio. Its price will fluctuate around $1 as close as possible. After the sUSD coins are minted, users can mint or trade synthetic assets.

The price of synthetic assets is not determined by market depth but by the exchange rate provided by the oracle machine. For example, to keep the price of synthetic assets consistent with the accurate U.S. stock prices, Mirror will track and update the price every six seconds. However, beyond the trading hours of the U.S. stocks, the oracle machine will lose efficacy. At this time, users can no longer mint synthetic assets but can still trade at the closing price. Therefore, there are no counterparties or order books in synthetic asset trading, and users can only interact with smart contracts. Therefore, users need to beware of risks such as failure of the oracle or failure of smart contracts when trading.

The emergence of synthetic assets has dramatically lowered the threshold for users to participate in U.S. stocks and other exchanges. For starters, they are not subject to investigation or the trading hour limit. Also, synthetic assets combine tangible assets and digital assets, and expand the usage scenarios and the value of digital assets. For now, synthetic assets are still in their infancy, with perils such as excessive over-collateralization rates and dynamic debt risks. However, a series of protocols for synthetic assets, such as Synthetix and Mirror, have received support from many users, indicating a significant market demand. If you are interested in synthetic assets, why not try them out in CoinEx Wallet? https://wallet.coinex.com/download